International expansion, local content, sports rights key for OTT

Time:2022-01-23

Views:3336

Reprinted from Rapid TV News

As part of a number of predictions for the entertainment industry in 2022, research firm Ampere Analysis is forecasting that over-the-top (OTT) services will aim to grow their subscriber bases this year by focusing on markets beyond North America and Western Europe and diversifying their content offering.

The study noted that after the pandemic disrupted filming schedules and with the fierce competition between the SVOD platforms, a large quantity of new high-quality scripted shows can be expected in the next months as more players launch internationally and bolster their international offers to combat saturation in established OTT video markets.

Ampere calculated that at the end of 2021, Netflix was present in over one third of all Western European homes, and Amazon Prime in more than a fifth. Studio-led OTT services were also seen to be rushing to enter new markets to carve out their own piece of the pie. Disney+ was cited in this regard, set to expand its presence in EMEA this summer, while HBO Max was eyeing Eastern Europe. Similarly, Paramount+ and Peacock are working together to enter the Eastern European market early.

In large emerging markets, such as India, the study found a high engagement with local TV shows and films. As a result, companies like Netflix and Amazon Prime are beginning to tap into local content production hubs to create content capable of attracting new customers and also maintaining their current subscriber bases. As SVOD platforms continue to diversify their content offerings, targeting different markets, Ampere expects more partnerships with local independent production companies.

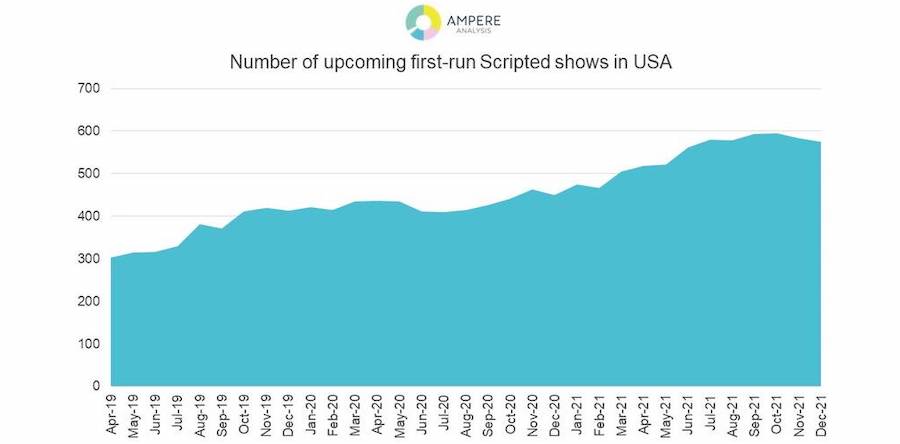

Yet despite the growth in the number of these partnerships, the firm also noted that competition within the market has intensified, particularly between the platforms, whose need for exclusive original content has led to an increase in the volume of brand new scripted shows being commissioned.

Ampere says that the slowing of releasing over the last 18 months due to the pandemic, consumers can expect a large quantity of high-quality scripted shows landing in market over the course of the next 12 to 18 months. It said there was already evidence of this in the US, where the volume of scripted shows released reached pre-pandemic levels for the first time in October 2021, crowding the weekly release schedules.

Going forward, Ampere Analysis expects that as companies grow their original slates, content spend will continue its upward trajectory it has shown over the past few years, with global spending on acquired, original and sport content set to hit roughly $240 billion by the end of 2022, a 6% uplift compared with 2021.This rise it says will be driven heavily by an increase in spend from SVOD players.

The latter cohort are expected to be responsible for over a fifth of global content spend in 2022. Content investment from AVOD services, which are growing rapidly in reach across many markets, still remains relatively low as much of the content available on AVOD is licensed non-exclusively with linear channels or other streaming services but Ampere pointed to the likes of Roku investing in original content.

Sports has been a strong contributor to content spending growth in the past decade and Ampere expects that this industry will represent an important part of content spend expansion over the next five years. Although sports rights remain a local market, with some downward pressure on top-tier rights, as competitions become more visible overseas, there are more chances for international commercial growth, especially for European football leagues.

Ampere expects that in 2022 the English Premier League will become the first major national competition that will generate more revenues from international TV deals than its domestic ones.

The Premier League’s international revenues have more than tripled in the last decade and now represent around 47% of the total broadcast revenues. Domestic deals are expected to stay the same for another cycle until 2025, at just over $2 billion per season, whereas new international deals – such as the recent deal with NBC Universal in the US, for a reported $450 million per season – are set to take the international TV revenues up to around $2.4 billion from 2022, thus making up 54% of the total revenues generated from broadcasting fees this year.

官方公众号

(扫一扫关注我们)